A risk premium is the amount of income a person is willing to give up to either avoid a risky situation (risk aversion) or for the opportunity to engage in a risky situation (risk loving). It is identified as the difference between income available with certainty (involving no risk) and income that does involve risk, both or which generate the same level of utility.For a risk averse person with decreasing marginal utility of income, the risk premium translates into the amount of income paid for insurance, that is, an insurance premium. Insurance is the service that transfers risk from an individual to a larger group, often represented by an insurance company. For a risk loving person with increasing marginal utility of income, the risk premium is not only the amount of income paid to engage or risk, it's also the amount of additional income needed to avoid risk. A risk neutral person with constant marginal utility of income has no risk premium

Income and Utility

The taks of identifing risk premium as the difference between certain income and risky income is greatly assisted by first identifying certain income and risky income.- Certain Income: This is income obtained with absolutely certainty. There is no risk involved. In this analysis of risk aversion, certain income can be thought of as the amount of income that a person has without engaging in a risky situation or wager. There is no chance of receiving any more income or any less income.

- Risky Income: This is income based on the results of a risky situation, such as a wager. The risky situation might result in more income or less income. The amount of risky income is specified as the expected value, a balance between the probability of the lost income and the probability of gained income.

Two related utility concepts also need a bit of discussion.- Utility of Expected Income: This is simply the amount of utility generated by income. It is identified by a utility curve such as presented in the above exhibit. It is the utility generated by certain income. Or it is the utility associated with expected income.

- Expected Utility: This is the average utility expected from a risky situation. Like expected income, it is the utility obtained with a loss, weighted by the probability of losing, plus the utility obtained with a win, weighted by the probability of win.

A Risk Averse Premium

Risk Premium:

Risk Aversion |  |

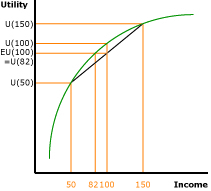

The risk premium for a risk averse person can be illustrated with the exhibit to the right. Income is measured on the horizontal axis and utility is measured on the vertical axis. The concave curve in the exhibit is decreasing marginal utility of income characterizing risk aversion. The slope of the curve is steep then flattens.In this illustration, certain income is equal to $100. Risky income is the result of a 50-50 chance of winning or losing $50, resulting in an expected value of the wager of $100, as well.

Even though certain income and risky income are equal, the utility differs. The utility generated by the certain income is U(100). The expected utility resulting from the wager is EU(100). This is effectively the average (weighted by the probablity of each outcome) of the utility of wining U(150) and and losing U(50).

The key to risk aversion is that the utility of the certain income U(100) is greater than the expected utility of the risky income EU(100). Moreover, this also means that a smaller amount of certain income ($82) generates the same utility as the $100 risky income, EU(100) = U(82).

The risk premium is the difference between the certain income of $82 and the risky income of $100. This risk averse person is willing to pay up to $18 in order to avoid the 50-50 wager that involves either a $50 win or a $50 loss.

A Risk Loving Premium

Risk Premium:

Risk Loving |  |

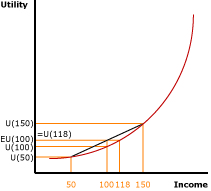

A qualitatively comparable, but quantitatively opposite risk premium exists for a risk loving person. This alternative is illustrated with the new exhibit to the right. The set up is the same. Income is measured on the horizontal axis and utility is measured on the vertical axis. The difference is that this convex curve is increasing marginal utility of income characterizing risk loving. The slope of the curve is flat then steepens.Once again certain income is equal to $100. Risky income is the result of a 50-50 chance of winning or losing $50, resulting in an expected value of the wager of $100.

And even though certain income and risky income are equal, the utility differs. The utility generated by the certain income is U(100). The expected utility resulting from the wager is EU(100), the weighted average of the utility of wining U(150) and and losing U(50).

The key to risk loving is that the utility of the certain income U(100) is less than the expected utility of the risky income EU(100). Moreover, this also means that a larger amount of certain income ($118) generates the same utility as the $100 risky income, EU(100) = U(118).

The risk premium is the difference between the certain income of $118 and the risky income of $100. This risk loving person is willing to pay up to $18 in order to engage in the 50-50 wager of winning or losing $50. Or in other terms this risk loving person would need to be paid $18 NOT to engage in the wage.

A Risk Avoing Insurance Premium

The risk premium a risk averse person is willing to pay to avoid risk is also the maximum payment for purchasing insurance. Insurance is a service that transfers the risk of losses from an individual to a larger group. The larger group is typically represented by an insurance provider. This transfer of risk is undertaken in exchange for a premium payment. That is, the individual agrees to incur a small guaranteed loss (the premium) but avoids incurring a less likely but much larger loss.For example, a person pays an automobile insurance premium each month (guaranteed), but shifts the (slight) risk of a major expense associated with an accident to the insurance provider. The maximum premium that a person is willing to pay is equal to the risk premium difference between risky income and certain income.

The insurance provider then spreads this slight risk of a large expense for one person over a large group, the vast majority who pay the premium but do not incur the expense. Suppose, for example, that insurance is provided to 100 people and one member of this group is involved in an accident that incurs a cost of $20,000. The insurance provider spreads this $20,000 expense over the 100 people by charging each a premium of $200.

The insurance provider knows that 1 of the 100 customers will incur the $20,000 expense, it just doesn't know which specific person it will be. The insured person then gives up $200 of certain income to avoid the risk of incurring a $20,000 loss.

RISK PREMIUM, AmosWEB Encyclonomic WEB*pedia, http://www.AmosWEB.com, AmosWEB LLC, 2000-2025. [Accessed: July 1, 2025].